Apple has announced a new post-payment feature called ApplePay Later. The service allows Apple Pay purchases to be split into four instalments over six weeks and paid without interest or late fees. This feature is designed to help users better manage their finances by providing a more flexible payment option.

Users with postpay functionality can apply for Apple Pay Later loans ranging from $50 to $1,000 to pay for online and in-app purchases that accept Apple Pay. To take advantage of postpay, apply for a loan within the iOS Wallet app and agree to the terms of Apple Pay Later. A subsidiary called Apple Financing will review the loan application and report to the US credit agencies this fall.

Apple plans to roll out Apple Pay Later to all “qualified” users of iOS 16.4 or iPadOS 16.4 over the next few months, with some users randomly getting a pre-release version. Apple Pay Later was originally scheduled to debut with iOS 16 but was delayed due to technical issues.

Apple Pay Later will be enabled through the Mastercard Installments program, with Goldman Sachs as the issuer of the Mastercard payment entitlement used to complete the purchase. This means users can use their Mastercard credit card to purchase using Apple Pay Later.

Apple Pay Later competes with existing postpaid services and has the potential to further grow the postpaid market by offering users easier and more secure options.

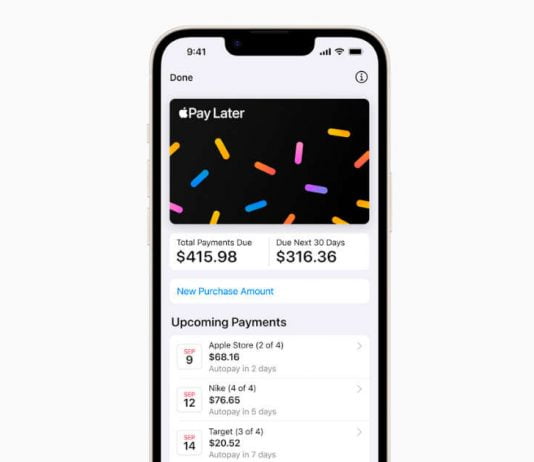

To use Apple Pay Later, you first need a device with a compatible iOS or iPadOS version. In addition, a postpay option will now appear when purchasing at merchants that accept Apple Pay. If you choose to purchase later, your Apple Pay Later loan payments will appear within the Wallet app, with a calendar view of your 30-day loan payment schedule.

Apple Pay Later is expected to offer consumers a new option in the post-payment market, offering flexible and easy payment options that appeal to a wider audience. It is currently launched for users in the US, which will be expanded soon.