A cloud-based accounting solution is the future of business. A SaaS model may be right for you if you want to stay competitive in your market and avoid costly upgrades. The benefits of software-as-a-service (SaaS) solutions are numerous. They allow businesses to access real-time data analytics and provide data security while making it easier to transition between different platforms.

Mordor Intelligence predicts that by 2026, the accounting software market will reach a valuation of $19.59 billion. The rise of cloud-based accounting software has opened up new possibilities for business. This article will explore why SaaS solutions are the future of accounting, how they work, and what benefits they offer companies.

Contents

- 1 Why Is Cloud-Based Accounting Software Important?

- 2 Gone Are the Days of Manual Bookkeeping and Deposits

- 3 Customers Can View Their Statements and Pay Bills

- 4 Any Business Can Use SaaS to House Its Bookkeeping Needs, Regardless of Size

- 5 Software-as-a-Service Accounting Solutions Provide Data Security

- 6 SaaS Accounting Software Provides Real-Time Data Analytics

- 7 SaaS Applications Allow You to Set up Electronic Payments

- 8 Conclusion

Why Is Cloud-Based Accounting Software Important?

Cloud-based accounting software is a cost-effective solution because it eliminates the need for expensive hardware and ongoing maintenance. Cloud-based accounting applications are easy to use, with no installation required.

They’re secure, as they don’t store any data on your computers. Everything is hosted by your provider, meaning you don’t have to worry about hackers getting into your system and stealing sensitive information. For example, if you use QuickBooks software to manage your accounts, you can access your QuickBooks files remotely by storing them on a service provider’s servers.

However, working with and managing the Quickbooks software requires expertise and skills. Using the software might be useless if you don’t have the right skills. Hence, it is best to seek help from a QuickBooks hosting provider. A hosting provider can help you host your Quickbooks files and other data so that you can access them securely whenever and wherever you want.

Gone Are the Days of Manual Bookkeeping and Deposits

You no longer have to keep track of your business’s financial information manually. Gone are the days of manual bookkeeping and deposits. Now, you can use a SaaS accounting application that automatically processes data and organizes it into reports. In fact, in a survey by Harvey Nash, respondents voted SaaS as the most helpful technology in helping companies achieve their business goals.

Customers Can View Their Statements and Pay Bills

SaaS solutions allow you to access your accounts and manage them from anywhere. Unlike traditional accounting, which often requires customers to visit an office or home-based office, SaaS solutions are accessible to all individuals with an internet connection.

Customers can view their statements and pay bills anytime and anywhere it’s most convenient for them. This means that clients can view their account balances online anytime without making a special trip or calling for help. This is important because most consumers would switch service providers for a better payment experience, according to research from Pymnts.

Any Business Can Use SaaS to House Its Bookkeeping Needs, Regardless of Size

SaaS accounting applications are the perfect solution for any business. According to a survey from McKinsey, most businesses expect half or more of their applications to be in the cloud within three years. Regardless of the size of your company, SaaS-based bookkeeping software can provide several benefits.

- Small businesses: SaaS is ideal for small businesses because it’s cost-effective and easy to use. It also allows them to focus on their core competencies without worrying about the accounting side of their business.

- Large companies: Bigger companies may have difficulty finding skilled employees to manage their finances and manually track all financial records. With SaaS, they can outsource this work while maintaining control over handling accounts. In addition, they’ll save money in the long run by not having to hire extra staff or pay higher fees associated with traditional bookkeeping services.

Software-as-a-Service Accounting Solutions Provide Data Security

SaaS accounting applications are hosted in the cloud, which can be accessed anywhere, anytime. This is important because it means that you and your clients can access your financial data no matter where you are.

The data is encrypted when it is sent over the internet and when it’s at rest on the server. Data encryption also happens when information is transmitted between different systems. In addition to being encrypted, SaaS applications typically use redundant storage so that if one location goes down or gets damaged, copies of your information will still be elsewhere available for retrieval.

SaaS Accounting Software Provides Real-Time Data Analytics

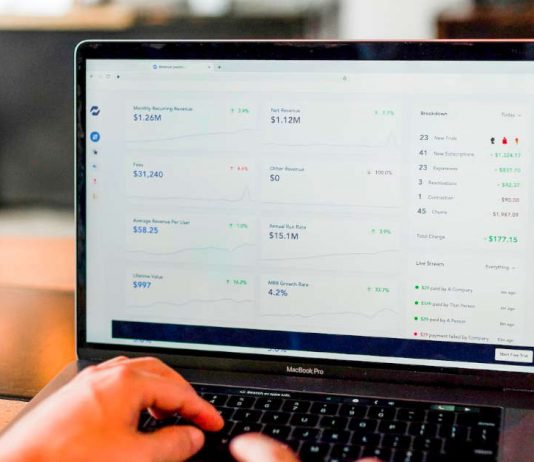

SaaS accounting software allows you to monitor your business in real time. This means that you can use data analytics to make better business decisions and then take action on those decisions immediately.

Data analytics allows you to see where your customers are coming from, what they’re interested in, how much revenue they generate for your company, and more. You can also use data analytics to gain insights into customer behavior so that you know what products or services might appeal to them most.

SaaS accounting applications provide a wealth of information about every aspect of your business. The more information you have, the more informed your decision-making will be. With SaaS accounting software, it becomes easier than ever before for entrepreneurs like yourself who want a leg up on their competition but don’t want anything holding them back from success.

SaaS Applications Allow You to Set up Electronic Payments

Electronic payments are the wave of the future. The McKinsey 2022 Digital Payments Consumer Survey found that nearly nine in ten Americans are now using some form of digital payment. They’re easier, more secure, and more efficient than using checks. Plus, they have a lot of advantages for your business:

- They save time and money. With electronic payments, money is transferred automatically between accounts. No more waiting for a check to clear or writing out an invoice manually. You simply enter all the relevant details into a system that takes care of everything else. This frees employees’ time to focus on other important tasks like growing their business instead of worrying about finances.

- They’re easier to manage than checks or cash transactions because all information related to each transaction is stored in one place. Hence, it’s easy to track how much money has gone through which account at any given time (or over longer periods). This helps reduce accounting errors that could cause problems later down the road when taxes come due.

It also reconciles accounts much faster than traditional methods like receiving physical checks from customers, which must be manually processed before entering them into an application.

Conclusion

SaaS accounting solutions are the future of business. They offer several advantages over traditional software, including lower costs and more flexibility. The best SaaS applications also have helpful features, like real-time data analytics and electronic payment capabilities. If you’re looking to upgrade your bookkeeping solution or switch from traditional software to SaaS, now is the right time.