Latest UpdatesRecent Stories

Stay Fit on the Go: 10 Best Android and iOS Fitness...

With a multitude of fitness apps available for Android and iOS, staying fit and healthy has never been easier. These apps are like having...

21 Best Education Apps for Android and iOS to Learn New...

Today education has gone digital, and mobile apps are leading the charge. Whether you're a student, a professional, or just curious, there's an app...

The Benefits of Live Streaming for Vloggers and Brands

Live streaming has become a key tool for vloggers and content creators seeking to expand their audience and strengthen their brand presence. Using platforms like YouTube...

Metaverse Expansion: Meta Partners with Microsoft and ASUS to Expand Horizon...

Meta is sharing its Horizon OS with other manufacturers to grow the metaverse. The platform will support new devices from companies like Microsoft, Lenovo, and...

Understanding Trends in Software Development and Selecting the Right Outsourcing Partner

Keeping pace with the latest trends and technologies is crucial for businesses aiming to stay competitive. Whether it's harnessing the power of AI or adopting the newest programming...

10 Best Horror Games for Android and iOS in 2024

Mobile gaming has transcended beyond the casual puzzles and action-packed shooters to offer an immersive horror experience that rivals even console games. Gone are...

Summer Adventures to the Next Level: Power and Chill with BougeRV’s...

As summer calls to us with its promise of endless adventures under the sun and stars, the savvy camper knows that beating the heat and staying...

Bitcoin Undergoes Fourth Halving: Cuts Mining Reward to 3.125 BTC, Promising...

Halving Reduces Rewards: Bitcoin's block reward halved from 6.25 BTC to 3.125 BTC on April 19, 2024. Scarcity Drives Price: The reduced Bitcoin issuance may...

Boston Dynamics Unveils New Atlas: Stronger, More Agile Humanoid Robot

The new electric Atlas robot by Boston Dynamics features swiveling joints and enhanced mobility, designed to perform complex tasks that exceed human capabilities. The updated...

Gen Z Prefers TikTok and YouTube Over Google for Searches, Study...

Gen Z prefers TikTok and YouTube for searches, not Google. They like the real, varied information on social media. Google is creating new AI tools to...

10 Best Photo Editor Apps for Android and iOS in 2024

We all love taking photos with our smartphones, right? But sometimes, they just don't look as cool as we'd like. Sometimes the lighting is...

13 Best Open-Source Encrypted Messaging Android Apps For Privacy Concerned People

Nowadays almost every famous chat apps available for Android supports encrypted messaging. However, some of them are owned by tech giants like Facebook tends us...

5 Ways To Deal With Google Storage Running Out Of Space

Many of you who rely on Google Drive has probably received a warning message telling you that Google storage running out — it has...

From Window Displays to Checkout Counters: Components of Successful Retail Merchandising

In the world of retail, successful merchandising is key to attracting shoppers, boosting sales, and fostering brand loyalty. Whether it’s eye-catching window displays or...

Android Unveils New ‘Find My Device’ Network to Locate Lost Devices...

Android’s ‘Find My Device’ forms a global network for locating devices even when they are offline. It mirrors Apple’s Find My feature, making it user-friendly...

12 Best Android Prank Apps To Fool Your Friends

Humor and pranks have found a new playground in the realm of smartphone apps. Android users, in particular, have a plethora of options to...

10 Best Productivity Apps for Android and iOS in 2024

It is now easier than ever to stay organised and boost productivity, thanks to the increased demand for productivity apps for Android and iOS....

FTX’s Sam Bankman-Fried Gets 25 Years in Prison for Multi-Million Dollar...

Sam Bankman-Fried, the former executive director of the now-defunct FTX exchange, has been sentenced to 25 years in prison. The sentencing, which took place...

10 Alternatives to Android and iOS You Should Know

The duopoly of Android and iOS dominates the world of mobile operating systems, leaving little chance for other platforms to make a substantial influence....

How Software Development Can Change Education?

In today's robust digital era, technology has become an integral element of every aspect of our lives, including education. As the world evolves, so...

23 Best Challenging And Hard Android Games You Should Try In...

Get ready to get frustrated because you are going to play some really hard Android games on your device. Challenging and hard Android games are always been...

Bankman-Fried’s Fate Sealed? 110-Year Sentence Looms for Disgraced FTX Founder

Sam Bankman-Fried, once hailed as the cryptocurrency monarch, now grapples with a potential 110-year prison sentence. Merely eighteen months ago, Bankman-Fried, at 30, had...

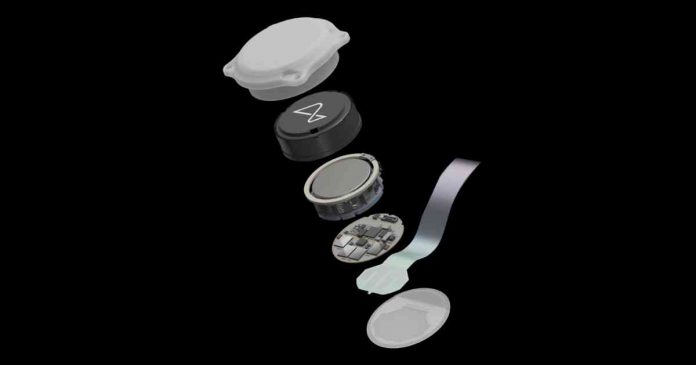

Elon Musk’s Neuralink Shows Paralyzed Patient Plays Chess with Mind-Controlled Cursor

Neuralink, the brain-chip company founded by Elon Musk, has demonstrated its first successful human trial. Noland Arbaugh, a patient paralyzed below the shoulders, was able to move...

Epic Games Store to Launch on iOS and Android by Year-End...

Epic Games announces its plans to launch the Epic Games Store on iOS and Android platforms by the end of 2024. According to a post on...

Android 15 to Enable SMS and MMS via Satellite Networks

Second developer preview of Android 15 has unveiled the ability to send and receive SMS messages via satellite connections. According to the change log, Android 15...