Historical patterns suggest that Bitcoin’s price typically hits a peak about a year after a halving. However, the recent surge to new all-time highs, reaching above $73,700, has unfolded just a month before the anticipated halving, deviating from the usual trend.

A major question being discussed in the financial community is whether the upcoming halving has already been taken into account in Bitcoin’s current market price. The recent increase in price may be due to market participants anticipating the halving and its potential effects on the price. However, it is uncertain whether the price will continue to rise after the halving, as seen in previous cycles.

On one side, the halving directly influences the supply side of the equation. By halving the mining reward, the event effectively reduces the number of new bitcoins being created and sold onto the market by miners. This reduction in the supply of new Bitcoin eases the selling pressure on miners, who often sell their rewards to cover operational costs. As a result, if demand remains constant or increases, the reduced supply pressure can naturally lead to higher price levels.

The market has a tendency to take into account the expected results of future events and adjust the price of a financial asset accordingly. This is referred to as the market discounting forthcoming events, and it plays a vital role in the world of cryptocurrencies, particularly Bitcoin. When it comes to Bitcoin’s halving event, traders and investors may change their positions in preparation for its anticipated impact. This anticipatory behavior could limit the price movement once the event occurs, as the market has already accounted for the new reality in advance.

Understanding the Halving

Scheduled to occur approximately every four years, the halving cuts the reward for mining Bitcoin transactions in half. This mechanism is designed to gradually reduce the supply of new bitcoins entering the market until the maximum supply of 21 million is reached.

Conversely, the halving acts as a significant market event that attracts widespread media attention, influencing market sentiment and speculative trading. CoinShares remarks on the halving as “a great marketing event” that reignites interest in Bitcoin, especially among those who might have previously assumed it had faded from relevance. This surge in attention often translates into increased buying activity, which can drive the price up in the short term.

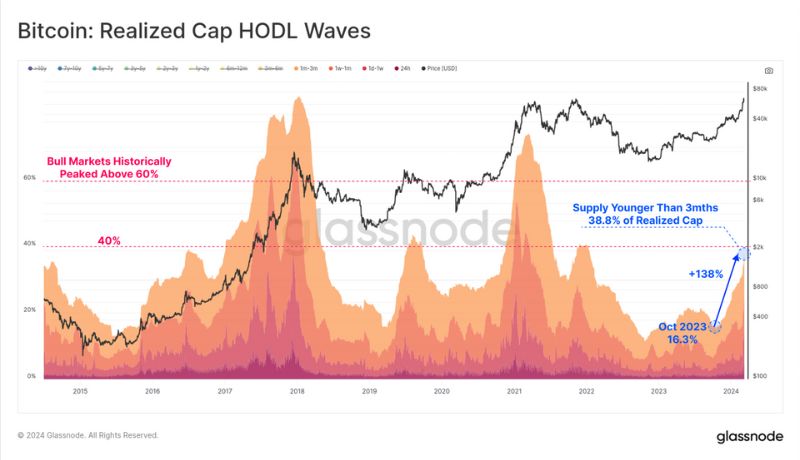

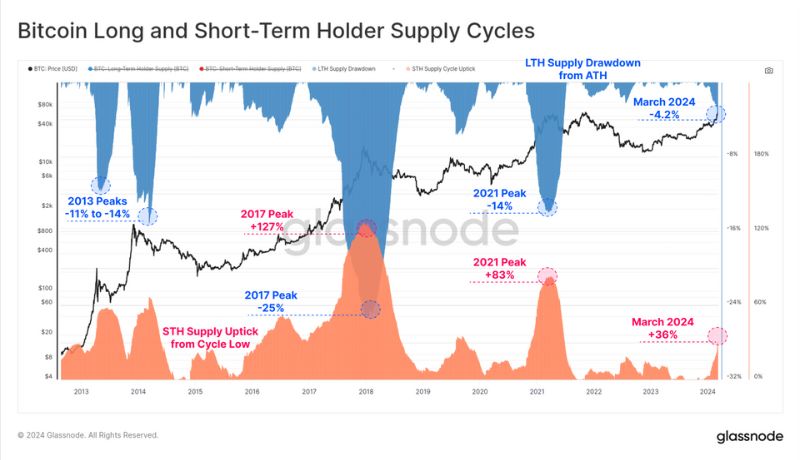

On-chain data presents a compelling narrative about Bitcoin’s market dynamics, especially in the context of the halving. In the months leading up to March 2024, there’s been a notable shift in the Bitcoin landscape, characterized by an increase in the proportion of bitcoins moved. From October 2023, this metric surged from 16% to 40%, signalling a heightened level of activity within the Bitcoin network.

According to Glassnode, a leading provider of blockchain analytics, this pattern is not just random noise but a hallmark of Bitcoin’s bull markets. However, it’s crucial to differentiate this current trend from those observed in the late stages of previous bull cycles. Historically, the proportion of bitcoins that have moved has reached over 60% when the market approaches its cyclical peak. This time, however, the market dynamics suggest a different story. The current figures, while significant, do not yet mirror the extremities seen at the height of past bull markets.

Glassnode’s analysis points to nuanced market behavior in which short-term investors are actively acquiring Bitcoin, whereas long-term investors, often referred to as ‘HODLers,’ are capitalizing on the price surge to realize profits. This shift in ownership, from long-term holders to new or short-term speculators, is a classic wealth transfer phenomenon observed in the Bitcoin ecosystem. Such transitions are often precursors to sustained market momentum, suggesting that there may still be room for upward movement in Bitcoin’s price.

Supporting this view, Nodecharts, another on-chain data platform, interprets the current capital inflow into Bitcoin as a sign of reaccumulation. In market terminology, reaccumulation is a phase where investors consolidate their holdings, often after a period of price consolidation or correction, in anticipation of future price increases. This behavior typically indicates a bullish outlook, where market participants expect the price to ascend further.

Moreover, the launch of Bitcoin exchange-traded funds (ETFs) in the United States has added a new dimension to the market’s dynamics. These financial instruments have attracted daily inflows, consistently exceeding the volume of Bitcoin mined each day. With the mining rate set to halve from 900 to 450 BTC per day, these ETFs are likely to exert additional upward pressure on Bitcoin’s price. Their buying activity, which at times surpasses ten times the daily mined amount, not only absorbs the new supply but also taps into the existing market reserves, potentially leading to a supply squeeze.

Risk Factors and Investor Caution

As Bitcoin approaches another halving milestone, the market’s anticipation is palpable, with prices reaching unprecedented highs. However, lurking beneath this exuberance are potential risks that could trigger price corrections, necessitating a cautious approach for investors. Analysts, including those from Rekt Capital, have identified a pattern that could signal a shift in market dynamics around the halving event, often referred to as the “danger zone.”

Historically, Bitcoin has exhibited a tendency for price declines in the days leading up to and immediately following the halving. This phenomenon is largely attributed to profit-taking activities, where investors, anticipating the event, sell off their holdings to capitalize on the price surge, a strategy known as “selling the news.” This pattern suggests that while the market is forward-looking, it also reacts to immediate stimuli, leading to short-term volatility.

The concept of the “danger zone” emerges from this cyclic behavior, marking a period where the price of Bitcoin is particularly susceptible to sharp declines. Investors, aware of past trends, often become cautious as the halving date approaches, fearing a repeat of the historical sell-offs. This fear, coupled with the actual act of selling by some market participants, can worsen price fluctuations, creating a self-fulfilling prophecy of sorts.

However, it’s crucial to note that these price corrections are typically short-lived. In past cycles, despite the initial downturns, the intrinsic value and demand for Bitcoin have reasserted themselves in the months following the halving. The market’s recovery post-halving has often led to parabolic increases in price.

It is essential to keep in mind that this article is not an investment recommendation but only shows points of view from different market players. It is essential for every investor to do their own research and manage the associated risks.